Reuters

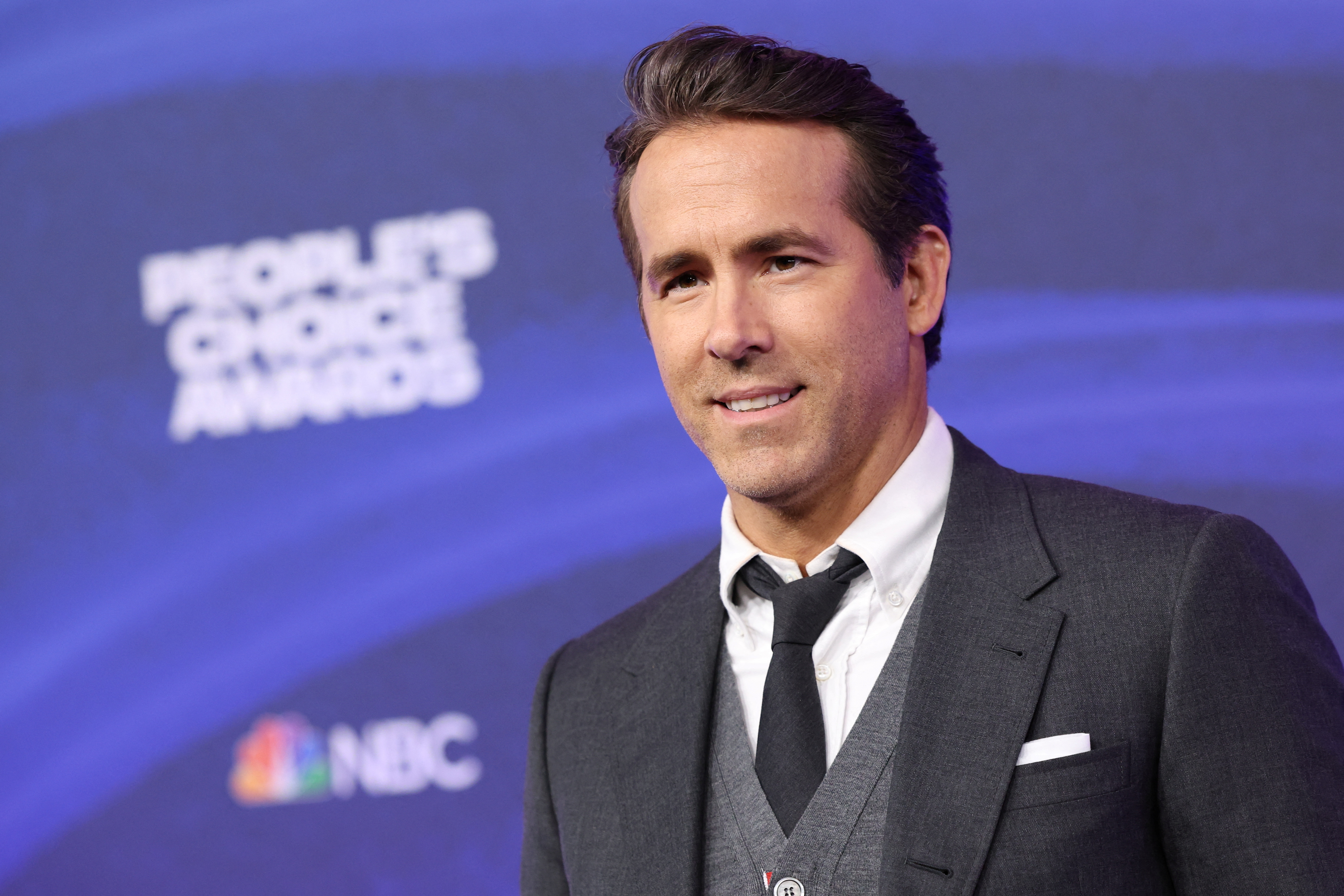

NEW YORK, March 20 (Reuters Breakingviews) – For Hollywood star Ryan Reynolds, dealmaking may be more lucrative than Deadpool. The actor, who owns an estimated 25% stake in wireless carrier Mint Mobile, is expected to ink $300 million from the company’s sale to T-Mobile US (TMUS.O), according to the Wall Street Journal. That comes after Diageo (DGE.L) bought Reynolds-backed Aviation Gin for $610 million in 2020. One more transaction like this, and Reynolds could find that he has a real future outside of the acting biz.

The Mint sale could net Reynolds four times what he earned three years ago when he sold his alcohol firm and was also the world’s second highest-paid actor, according to estimates from Forbes. For that company, he had some clever marketing maneuvers, like placing the tormented “Peloton wife” in a martini ad shortly after she appeared in a commercial for the exercise firm. For Mint, Reynolds has described the marketing strategy as “scrappy”, and he has done some catchy things, like appearing alongside T-Mobile’s chief executive in a video announcing the deal and leaving voicemails for customers.

Showing success outside of the lifestyle category – in mobile – is validation for the actor, but a differentiating factor might have been Reynolds’ ownership stake in Mint. Having some skin in the game is more motivating than smiling for a photo. Converting that stake into a lucrative deal, twice, suggests that Reynolds could be more than just a pretty face. (By Anita Ramaswamy)

Soucre: reuters.com